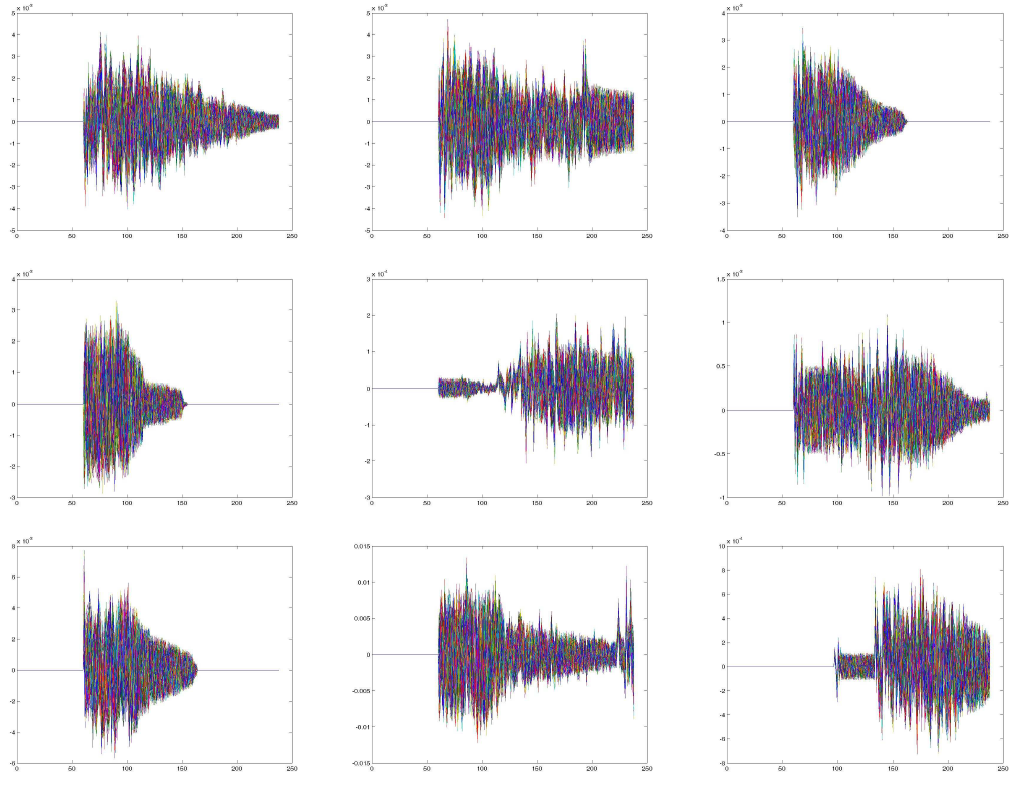

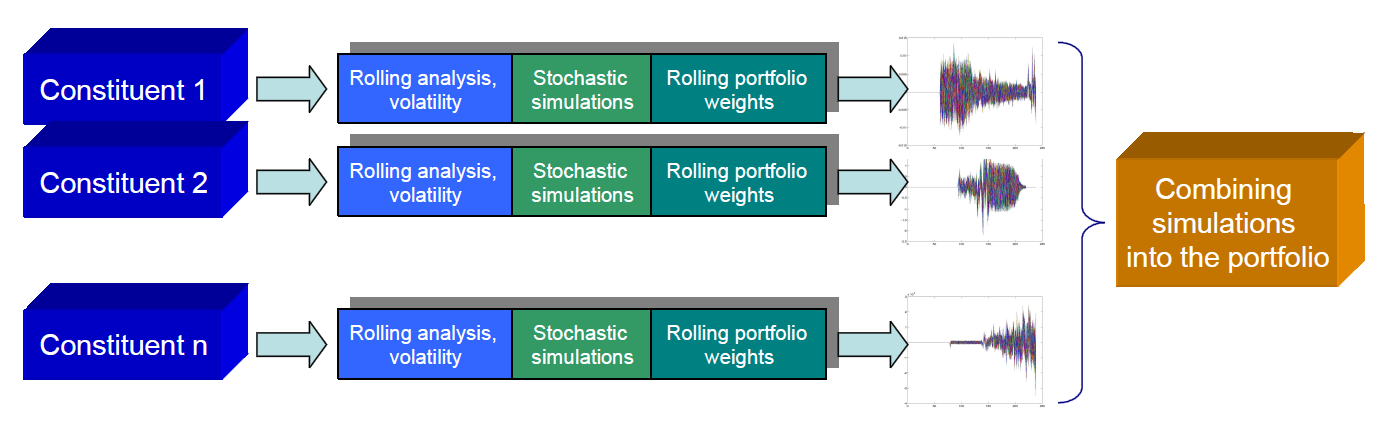

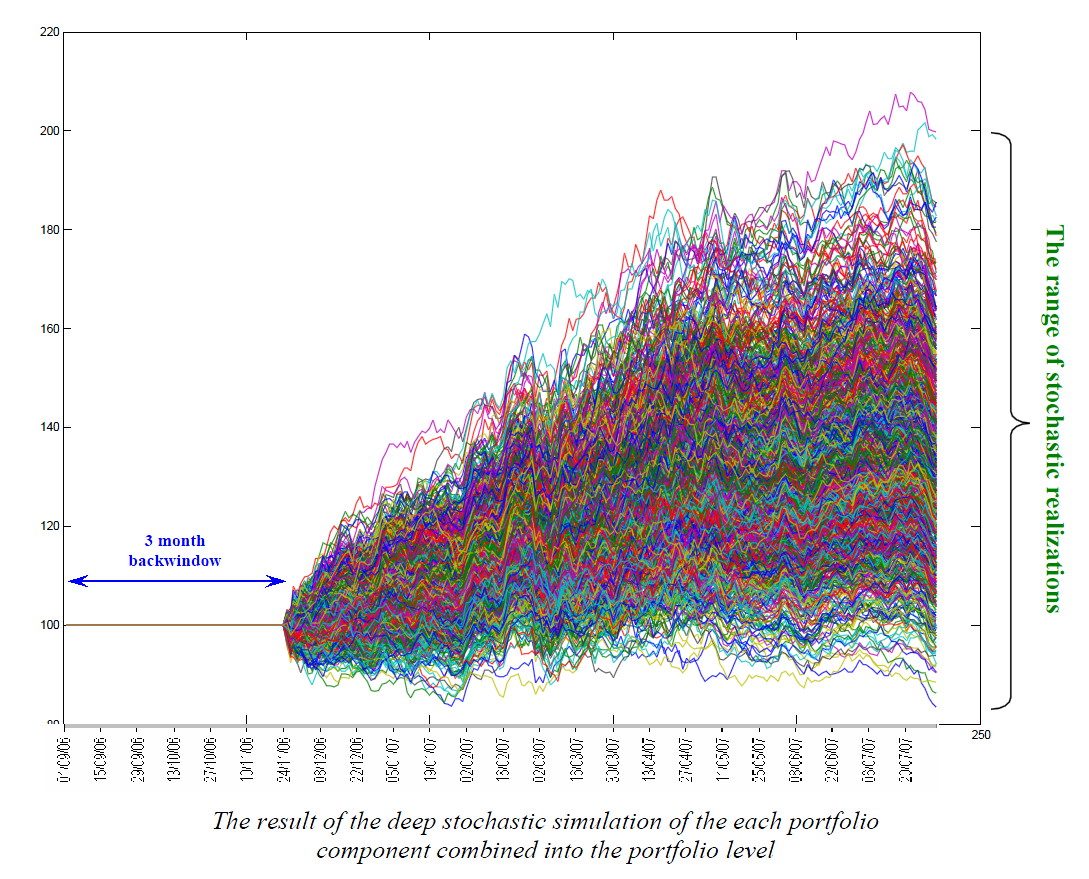

Stochastic Portfolio TestingRolling adaptive stochastic process applied to each portfolio component. In order to check how the fund would perform in the stochastic market environment we developed the rolling adaptive stochastic process applied to each portfolio component taking into account both directions and weighting of the particular instrument. That analysis could be the very important to find the potential stochastic bands and to approximate the worst-case and the best-case scenario. As well we are doing the simulation of the noisefor each portfolio constituent as a function of rolling volatility. The report and software is copyrighted, so we show only some extract from it. |

Home /

News /

About /

How We Think /

Products & Services /

Realised Projects /

Disclaimer /

Contact Us

Copyright © Stronghold s.r.o. 2013. |

Stronghold s.r.o. and this web site ("Applied Financial Solutions" www.apfins.com) accepts no liability whatsoever for any direct, indirect, incidental, special or consequential damages or damages for loss of profit, revenue, data or use incurred by you or any third party, whether in an action in contract or tort, arising from your access to or use of this web site or any other hyperlinked web site.